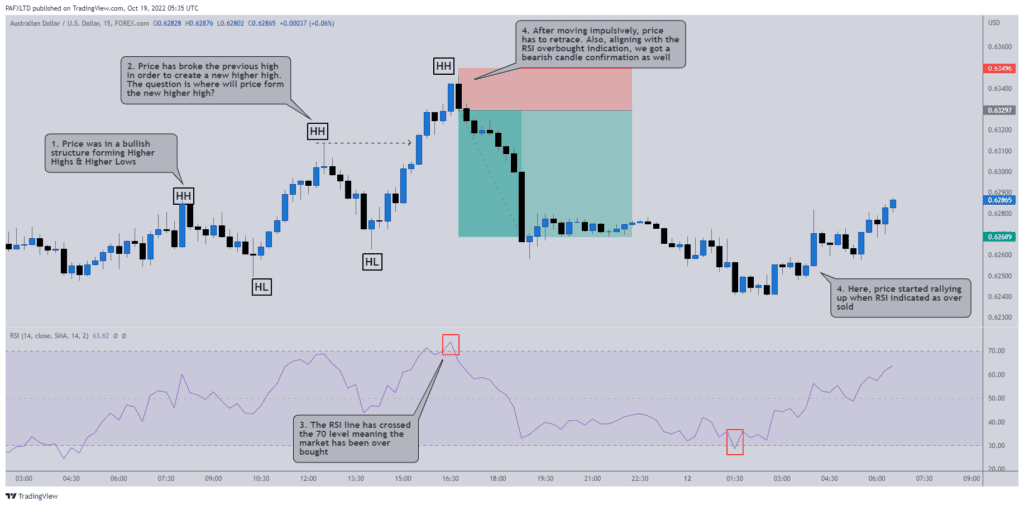

The Relative Strength Index(RSI) is usually used to detect when the market is overbought or oversold. The RSI can be used to make an intraday forex trading strategy that takes advantage of signs that a market has gone too far and is likely to go back in the other direction.

What is the RSI?

The RSI is a technical indicator to analyse the speed and the extent of price change of a particular movement. As a momentum indicator, the relative strength index compares a security’s strength on days when prices go up to its strength on days when prices go down.

The RSI is a common technical indicator that shows when a market is overbought when the RSI value is higher than 70 and when a market is oversold when the RSI value is lower than 30. Some traders and experts like the readings of 80 and 20, which are on the extreme ends of the scale. The RSI’s drawback is that fast, sharp price fluctuations can cause it to jump up and down repeatedly, making it vulnerable to misleading warnings. When compared to other signals, such as spikes or dips that indicate a trade confirmation, could signal an entrance or exit point.

In this article, we’ll be looking at how to use RSI in Forex.

Trading Setups Using RSI

If the market is overbought or oversold, it is common for the price to extend considerably further than the point at which the RSI signals it first. A trading strategy based on the RSI works best when it is paired with other technical indicators. This keeps traders from making trades too soon.

We’ve outlined a few ways to use the RSI and at least one other confirming indicator as part of an intraday forex trading strategy:

- MTRa

- Look for signs of an approaching retracement using other momentum or trend indicators. If the RSI indicates oversold readings, a retracement upward is much expected but it is not guaranteed to be happening accordingly.

If one of these additional conditions is met, it is considered good practice to consider entering a trade hoping to profit on a retracement:

- The MACD (Moving Average Convergence Divergence) has shown price divergence

- The average directional index (ADX) has shifted towards a probable retracement.

If the above conditions are met, consider starting the trade with a stop-loss order just beyond the most recent low or high price, depending on whether the trade is a buy or sell trade. The nearest identified support or resistance level might be used as the initial profit target.