To enter into the trading world, the first step to take is to find the best and most suitable broker in the world. So do it; there are plenty of options on the market that provide good leverage, security, and profit potential.However, there are many things to consider when choosing the best brokerage.

According to our research results, we have listed the five best forex brokers in the world. Along with the list, we have provided a brief overview of the firm and the basic features to consider while choosing a broker for you.

1. eToro

2. Vantage FX

3. Interactive Brokers

4. IC Markets

5. IG Broker

1. eToro

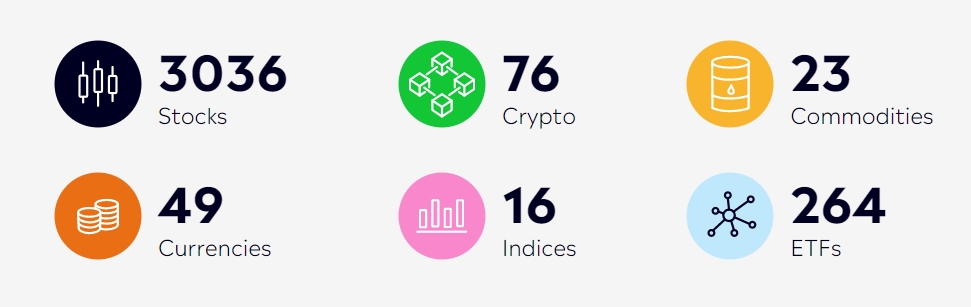

eToro is one of the most popular brokerages that offers a variety of instruments, from stock trading to cryptocurrency. It was one of the first to allow bitcoin right after its inception in 2014. Launched in 2007, eToro offers multi-assets with 3,056 symbols to traders from around the world.

Country of Regulation – FCA, CySEC, DNB, FinCEN, ASIC

Withdrawable Method – Credit/Debit card, Bank Transfer, PayPal, Neteller, Skrill.

Instruments – Multi-assets: Forex, U.S. Stocks, Crypto, Bitcoin (BTC), Ethereum (ETH), Amazon shares, Tesla, Apple, Nio, Litecoin, etc.

Commission – No deposit money, the platform charges a flat 1% spread on all purchases and sales of cryptocurrency. There is no commission for crypto, but there is a $75 account transfer fee for partial and full transfers. $10 for the inactivity fee; the withdrawal fee is $5.

Spread – Typical variable spread of 0.75 pip on the major pairs and 1, during volatile periods. The platform charges a flat 1% spread on all purchases.

Execute – 10 Milliseconds to 10 seconds.

Minimum deposit – $50- Unlimited.

Leverage – 20:1 for stock index CFDs

5:1 for stock CFDs

30:1 for forex

Platform – mt4/mt5, Mobile Apps, Android, and iOS.

Support – 4/5

Educational – 3/5

Account type – Cent account. Standard account ($50 – limitless)

………………………..

2. Vantage FX Markets

Situated in Sydney, Australia, Vantage FX Market is regulated by a first-tier country, which is why they are considered one of the most trusted brokerages in the world. Launched in 2009, Vantage is operating in 172 countries around the world. It has 1,000+ employees in 30 global offices. Vantage gives rebates that range from $2 to $8 per standard lot, depending on the balance and the amount of business done each month.

Country of Regulated – the Cayman Islands Monetary Authority (CIMA), Securities Investment Business Law T(SIBL) number 1383491, Australian Securities and Investments Commission (ASIC), AFSL No. 428901, registered in Cyprus with registration number HE428969.

Withdrawable Method – Bank Wire Transfers, Local Bank Transfers, Credit Cards, Debit Cards, Skrill, Neteller, BPay, Poli, and Unionpay transfers.

Instruments – More than 400 instruments. 1,000+ assets = Forex, U.S. Stocks, Crypto, Bitcoin, Ethereum, Litecoin, etc.

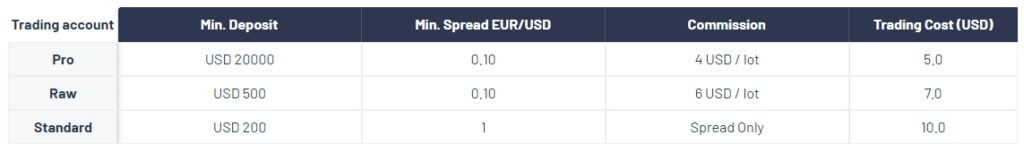

Commission – No deposit fees, The Standard Account has trading costs included in its variable spreads, while the Raw and Pro Accounts offer raw spread pricing in exchange for a commission per lot.

A $25 fee is charged for withdrawals via bank wire transfer.

Spread – typical variable spread of 0.09<> pip on the major pairs and 1<> during volatile periods.

Execute – 10 Milliseconds to 10 seconds

Minimum Deposit – Standard Account: 200 USD

Raw ECN Account: 500 USD

Pro ECN Account: 20,000 USD

Vantage FX’s Raw ECN and Pro ECN Accounts offer raw spread pricing and low commissions, but this is in exchange for minimum deposits of 500 USD and 20,000 USD, respectively.

Demo Account – MT4 Demo account with 300 available instruments

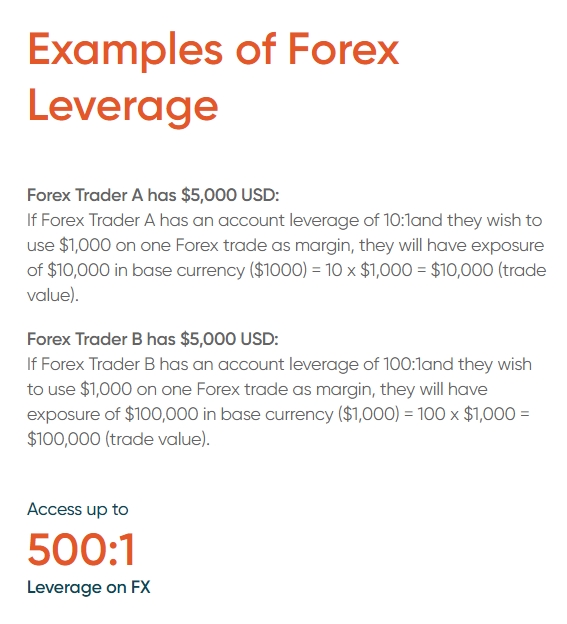

Leverage – up to a 1000:1

Generally, 500:1 for Raw, Pro, and Standard accounts.

Platform – MT4/MT5, ProTrader, Mobile Apps, Android and iOS

Support – 5/5

Educational – 4/5

Account type – Raw account. Standard account, Pro Account ($50- unlimited)

……..

3. Interactive Brokers

The founding member of Interactive Brokers Group, Inc. has completed its 44th year as a Broker Dealer with more than $10.60 billion in consolidated equity capital. Interactive Brokers Group, Inc. was founded by its Chairman Thomas Peterffy. In 150 countries, 2,650+ employees are working to operate the broker house.

Country of Regulation – Interactive Brokers is listed publicly (NASDAQ: IBKR) and regulated in six tier-1 jurisdictions, making it a safe broker (low-risk) for trading forex and CFDs. Interactive Brokers is authorized by the following tier-1 regulators: Investment Industry Regulatory Organization of Canada (IIROC), Securities Futures Commission (SFC), Japanese Financial Services Authority (JFSA), Financial Conduct Authority (FCA), Monetary Authority of Singapore (MAS), Central Bank of Ireland (CBI)—Ireland, and the Commodity Futures Trading Commission (CFTC). See more…

Withdrawable Method- Bank Wire Transfers, Local Bank Transfers, Credit Cards, Debit Cards.

Instruments – Stocks. Bonds. Mutual Funds. ETFs. Options. Fractional shares. Futures, Forex, Metals, Bitcoin, etc.

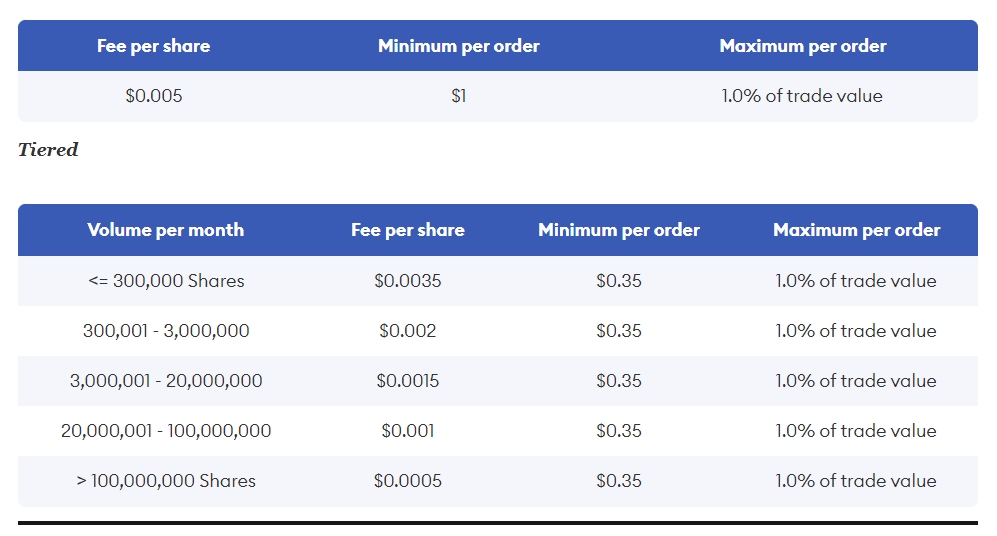

Commission – Interactive Brokers charges a commission per trade, which ranges from $16 to $40 per million round turn. IBKR Pro charges commissions, offering both fixed and tiered pricing options. Under the fixed pricing system, you owe $0.005 per share for stock trades, with a minimum fee of $1 and a maximum of 1% of the total trade value. Its tier pricing per share depends on the volume per month and ranges from $0.0035 for 300,000 or fewer shares to $0.0005 for more than 100,000 shares. The minimum is $0.35 per trade, and exchange and regulatory fees aren’t included. Their other account fees are also minimal, such as a very low $10 fee for outgoing wires.

Given the minimum commission of $2 per side, trading anything less than 100,000 units of currency becomes proportionally more expensive.

Initial deposit – $00 from demo to $100,000 in real.

Leverage– Up to a 500:1

Platform- WebTrader, Mobile App, Desktop platform, Android, iOS, but MetaTrader is not available.

Support- 3/5

Educational – 5/5

……………..

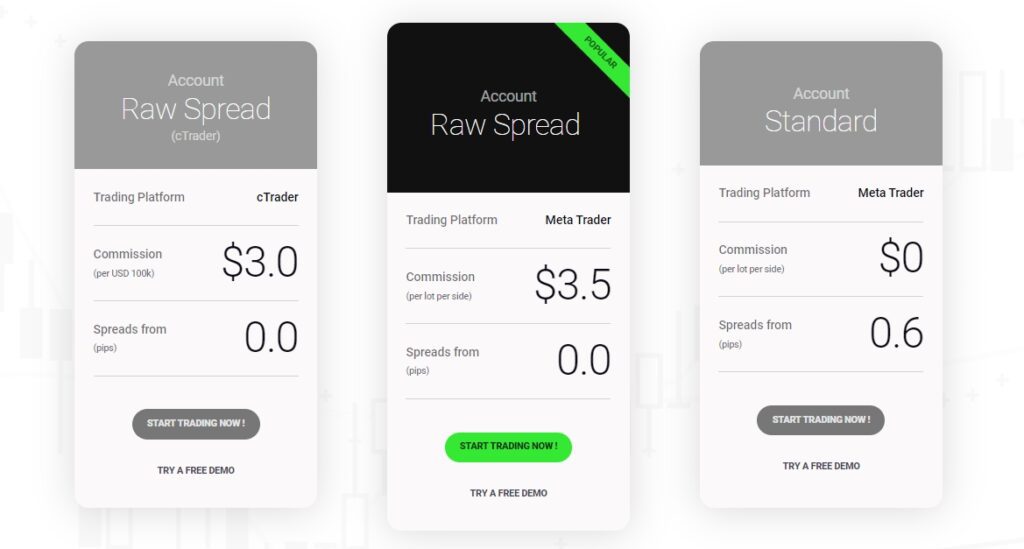

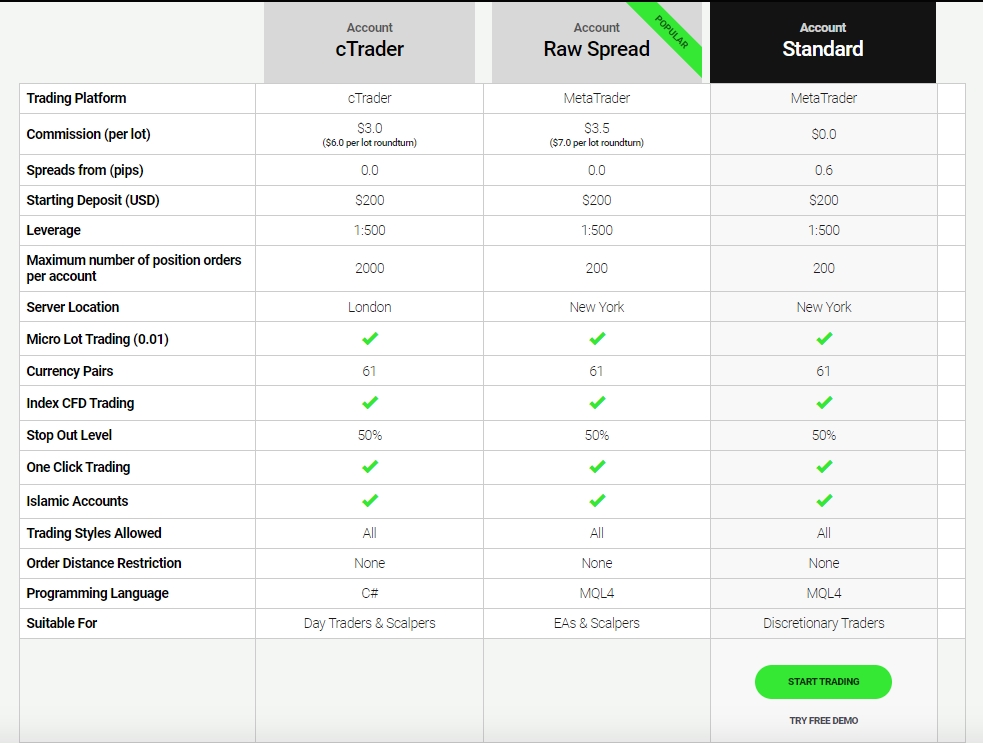

4. IC Markets

IC Markets was founded in 2007 in Australia and holds licenses from some of the strictest regulators in the world. It is a reputable forex CFD provider for day traders, scalpers, and beginner forex traders. IC Markets provides better liquidity, low latency connections, and cutting-edge trading platforms. IC Markets revolutionizes FX trading online. Traders may now access prices formerly accessible exclusively to investment banks and HNWIs.

Country of Regulation – Cyprus Securities and Exchange Commission (CySEC), Financial Services Authority (FSA), Securities Commission Bahamas (SCB), Australian Securities and Investments Commission (ASIC),

Withdrawal Method- Bank wire transfers, Local Bank Transfers, Credit Cards, Visa, MasterCard Secure Credit, Debit Cards, Skrill, Paypal, Neteller, Skrill.

Instruments– Forex, Stocks, Crypto, Bitcoin, Crypto, Bonds, Commodities, Indices, Futures etc.

Commission – No deposit fees,

Initial deposit – $200

Leverage – Forex Leverage 500:1

Indices 200:1

Commodities 500:1

Bonds 200:1

Cryptocurrency 1:200 Leverage MT4/MT5, 1:5 Leverage cTrader

Futures 200:1

Platform

Support – 3/5

Account type –

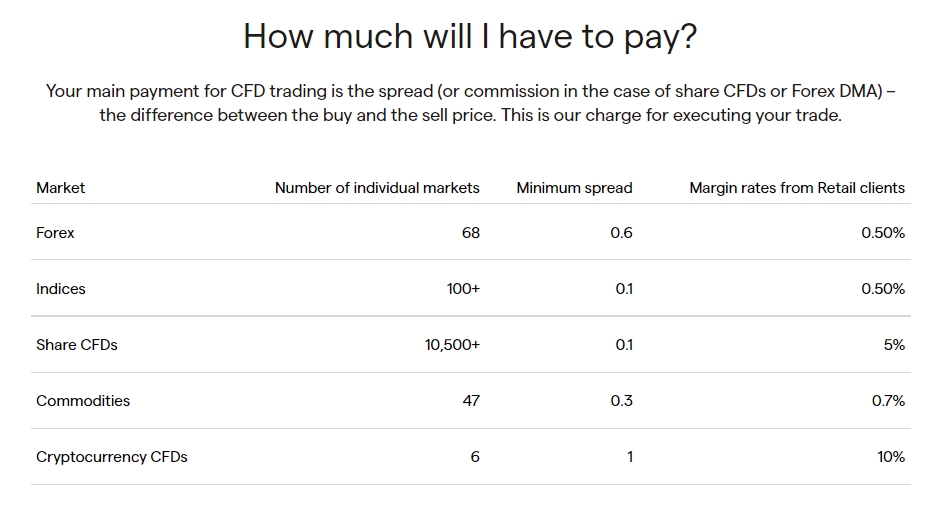

5. IG Markets

IG Market was established in the UK in 1974, is one of the world’s most renowned CFD brokers. The broker serves 313,000+ clients with 18,000+ assets.

Country of Regulation – Australian Securities & Investment Commission (ASIC), Japanese Financial Services Authority (JFSA), Monetary Authority of Singapore (MAS), Swiss Financial Market Supervisory Authority (FINMA), Financial Conduct Authority (FCA), Financial Markets Authority (FMA) – New Zealand, and the Commodity Futures Trading Commission (CFTC).

Withdrawable Method- Major Debit/Credit Cards, Bank Transfer, using the PayPal system, Skrill or Neteller.

Instruments– 18,000+ assets including 20,000 CFDs: ETF, Forex, Options, CFD, Stocks in some countries, Robo-advisory in UK, IPOs etc.

Commission – No deposit fees, Trade spreads from 0.6 points on key FX pairs, 0.8 points on major indices, and 0.1 points on commodities.

Minimum deposit – $300/€300/£250

Demo Account – Available.

Leverage – up to 50:1 – 200:1

Platform –

Support – 4/5

Educational – 3/5

Account type – Demo Account and Real Account

As per my opinion IC market is the best forex broker I had ever used so my vote goes to ic market

Great for you Mr Kumar.

If they are best, why aren’t they in the United States

I wish any of the 5 is in Nigeria. What is your advise on the brokers that are operating in Nigeria, can you give an appraisal of a few of them? Especially Hotfotex and Fxtm.

Regards

Sunny

Thank you for your comment. We will try to give some overview on forex brokers in Nigeria soon.

Thanks for sharing best information

You are most welcome dear.