Price Action Strategies: Know more to win more

Share

Price action trading is purely based on actual price data without relying on any other information like indicators, trading algorithms, market news or technical analysis tools, etc. Traders use different types of charts to interpret any market trends. Price action strategy is interpreted using the patterns of these charts to find market prices.

Price action is the foundation from which technical analysis is done, as it uses past price data to determine any trading decision. Short-term traders depend on price action to make trading predictions.

Market price movements allow traders to utilize trends and trading signals for doing profitable trading. These signals altogether form price action trading strategies. It helps to accurately predict any future movements to give you the best trading opportunities.

Let’s find out the different types of price action trading strategies that can best help us understand market behavior.

Forms of price action trading

Price action patterns are also known as price action signals, that create the basis of any trading. The market is very volatile to predict, so various price action strategies have been developed and tested over the years to better understand market trends

The following are some common price action strategies you can use to trade the market.

- Inside bar break out patterns,

- Pin bar patterns,

- Fakey patterns,

- false breakout patterns

Inside bar pattern

An inside bar pattern consists of a two-bar pattern, one is an inside bar and the other one before this inside bar is a ‘mother bar’. This strategy is used as a breakout pattern in trending markets, and can also be traded as a reversal signal.

Inside bars can also be traded in counter-trend from key chart levels.

Pin bar pattern

A pin bar strategy has a single candlestick price bar and it provides data that shows any rejection of price and a reversal point of the current market. You will find different entry options when trading with pin bars. The first entry simply means to enter the trade at the current market price.

An “on-stop” entry is also used by a trader to enter a pin bar signal.

Fakey pattern

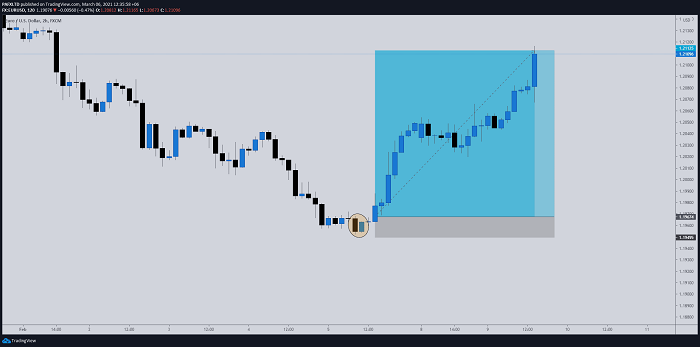

The fakey pattern strategy consists of a false breakout from an inside bar pattern. Fakey is one of the great price action strategies as it can help us predict possible profit.

When the price is initially at the breaking out point from the inside bar pattern but suddenly reverses to create a false-break and closes back within the range of the mother bar, then you can say we have a fake pattern.

Inside Bar + False-Breakout = Fakey pattern.

False-breakout patterns

False breakouts are very important price action trading patterns that can strongly suggest to you any change in prices or market trends.

A false-break of a level can look very deceiving because it looks like at any point the price will breakout but then it suddenly reverses fast. It confuses traders as they think of it as an obvious breakout and then the next moment it changes back.

Conclusion

Price action analysis is most significant in forex trading as it makes you understand the market’s price movement. Experienced price action traders have become more better at identifying any profitable trading opportunity, through years of practice.

The price action strategies work best when you know how to utilize them with great tactics. It is not only great to predict the next market move, but it is also considered as the backbone of forex trading.